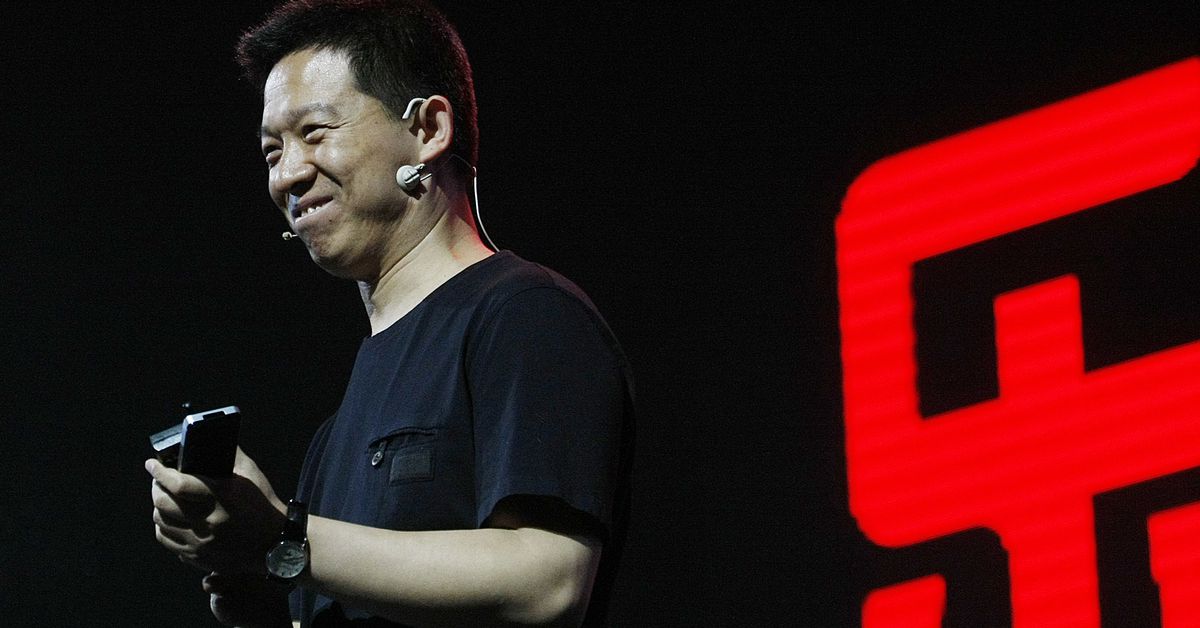

Seven months after he filed for Chapter 11 bankruptcy to deal with $3.6 billion in personal debt, the reorganization plan laid out by Jia Yueting — the tycoon founder of troubled EV startup Faraday Future — has been approved by a judge.

In overly simple terms, the majority of the people and companies he owes money to — largely thanks to the collapse of LeEco, the overly-leveraged tech conglomerate he built his fortune with in China — have agreed to swap their debt claims for pieces of Jia’s ownership stake in Faraday Future. They now only have a shot of being made whole if and when the struggling startup successfully completes a public listing on a major stock exchange.

Founded in 2014, Faraday Future has spent more than $1.7 billion (around $900 million of which was Jia’s) on its own and has yet to start manufacturing its first vehicle, a luxury SUV stuffed with screens known as the FF91. Instead, the startup is more famous for foibles linked to Jia’s penchant for bombast and his financial mismanagement — both of which The Verge have documented in recent years. And by its own admission the company needs $850 million in order to kickstart production of the FF91.

Jia repeatedly claimed in court that prolonged uncertainty about his personal debts would hold up any potential funding of Faraday Future, though no evidence was ever given of this. And since the idea all along has been to swap the the claims of those debt holders with stakes in the startup, he argued it was in their interest to approve his plan as quickly as possible. In December of last year, in fact, one of Jia’s lawyers told the court that Faraday Future did not have the “financial wherewithal” to make it another 60 days, according to a transcript. “Faraday will basically run out of cash,” the lawyer said at the time.

One former Faraday Future executive told The Verge last year they felt this was a “a gun to the head of the creditors. Lawyers for some of the companies Jia owes millions of dollars to made similar arguments in court that were ultimately unsuccessful.

Faraday Future has not run out of cash yet, though, thanks to a series of loans from a restructuring firm that it’s been working with since early 2019. Faraday Future also recently said it received a $9 million loan as part of the government’s pandemic-related “Paycheck Protection Program.”

Jia’s creditors were left with few other options than to agree to his plan, because he doesn’t have nearly enough personal wealth to cover the $3.6 billion hole he dug for himself. While Jia did buy a few multimillion dollar coastal mansions and land in Los Angeles before he self-exiled himself to the US in 2017 (to avoid increased pressure from the Chinese government over his debts), he told the court he divested himself of the actual ownership of that property. Even if that’s true, their total value is only in the tens of millions of dollars.

Jia’s bank accounts are also relatively empty, according to the paperwork he submitted to the court. In fact, he turned to cash-strapped Faraday Future to fund his bankruptcy in the first place. Jia borrowed $2.7 million from one of Faraday Future’s holding companies to launch his bankruptcy in October of last year, and has since taken on another $6.4 million loan from that same entity to fund the process.

In a statement released Friday, Faraday Future says the approval of the plan “has removed the biggest hurdle in [the company’s] equity financing efforts.” Earlier this week, the company’s new CEO (and former BMW executive) Carsten Breitfeld said those funding efforts are “a bit delayed” because of the pandemic.