Embattled German fintech firm Wirecard said it would be filing for insolvency over the $2.1 billion ‘black hole’ that’s led to the arrest of its CEO Markus Braun.

The Frankfurt Stock Exchange had earlier suspended trade in preparation of the announcement, Reuters reports. Wirecard is notably the first member of the exclusive DAX index to declare itself insolvent.

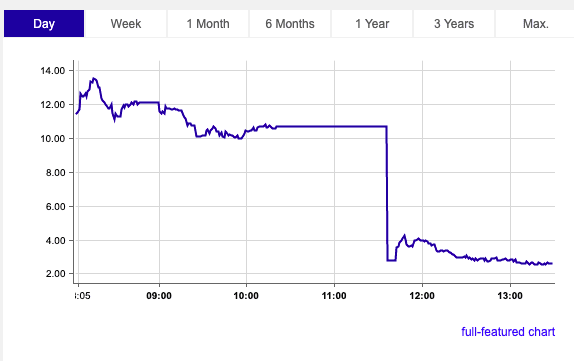

Wirecard stock had already fallen by 89% since last Wednesday — from $104.50 to below $12 — after the company disclosed its auditors had refused to sign off on its annual financial statements, citing 1.9 billion euro ($2.1 billion) in missing assets.

[Read: Wirecard’s missing billions: Do they exist, or did Germany just get its own Enron?]

Clearly, regulators wanted to ensure everyone had equal chance to dump their stock. And they did: Wirecard plummeted more than 75% in the minutes after trade resumed.

Braun, who made paper billions by pouring his own money into Wirecard post-dot-com boom, turned himself into the Munich prosecutors office on Monday.

Braun’s since been released after posting 5 million euro ($5.6 million) bail. Investigators are now probing other Wirecard execs for potential involvement in the scandal, grounded in allegations spanning more than a decade.

In light of surging interest in ‘bankrupt stocks’ (like Hertz), one might consider that traders could flock to Wirecard on news of its insolvency, leading to a miraculous pump.

Bankruptcy and insolvency aren’t exactly the same, but in Wirecard‘s case, it seems a resurrection is off the table. Indeed, the market seems to be putting its stock in its rightful place: the garbage. Let’s hope it stays put.

Published June 25, 2020 — 11:39 UTC