Advertisement

“I fucked up,” he said in the first tweet of a a lengthy, 22-part thread. In the post he acknowledged that he “should have done better,” and outlined a series of mistakes he alleges to have made including underestimating FTX users’ margins, overestimating cash availability, and not being transparent enough.

G/O Media may get a commission

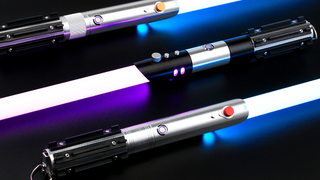

*lightsaber hum*

SabersPro

For the Star Wars fan with everything.

These lightsabers powered by Neopixels, LED strips that run inside the blade shape that allow for adjustable colors, interactive sounds, and changing animation effects when dueling.

Advertisement

“Right now, my #1 priority—by far—is doing right by users,” he claimed. “We’re spending the week doing everything we can to raise liquidity,” Bankman-Fried continued. FTX’s liquidity crisis means that many users who had funds tied up in the exchange have been unable to retrieve their money. So, it would seem the exchange’s first priority is in remedying that problem.

To do so, SBF is continuing his attempt to court Wall Street, blockchain, and venture capital big wigs to contribute rescue funds. “There are a number of players who we are in talks with, LOIs, term sheets, etc. We’ll see how that ends up,” the CEO tweeted. Some of the entities FTX is reportedly in discussions with are stablecoin platform Tether, crypto exchange OKC, and crypto founder Justin Sun, according to Reuters. In the internal memo cited by the outlet, Bankman-Fried wrote that he didn’t want to “imply anything about the odds of success.”

Advertisement

Just a couple of weeks ago, FTX was the third largest cryptocurrency exchange. But a series of mistakes made months ago finally caught up to the firm. In addition to FTX, Bankman-Fried is also the CEO of Alameda Research, a trading firm deeply intertwined with the exchange. SBF reportedly used money from customer deposits in FTX to prop up Alameda as that company lost money in the ongoing “crypto winter.” Reports of the shady dealing, and a lack of liquidity emerged.

Then, on Sunday, an ongoing spat between SBF and Binance CEO Changpeng “CZ” Zhao culminated in CZ’s exchange selling a large chunk of FTT, triggering a value drop and the beginning of FTX’s crisis. Briefly on Tuesday and Wednesday, it seemed that Binance might go from FTX-antagonist to white knight, but the merger between the two exchanges fell apart, which CZ blamed on the sorry state of FTX’s financial records.

Advertisement

Currently, Alameda is “winding down trading,” according to Bankman-Fried. FTT’s value is down from more than $59 this time last year to less than $4 today. And FTX’s downfall has had reverberations beyond the single exchange as well. On Wednesday, just about every cryptocurrency was trending downwards. Though some have made modest recoveries today, Bitcoin is still hovering around a 2-year low.