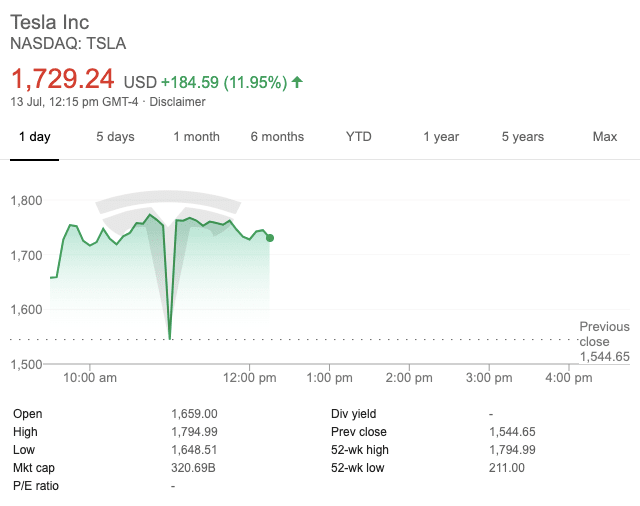

Tesla stock surged again on Monday, this time by more than 12% to reach an intraday high of $1,792.

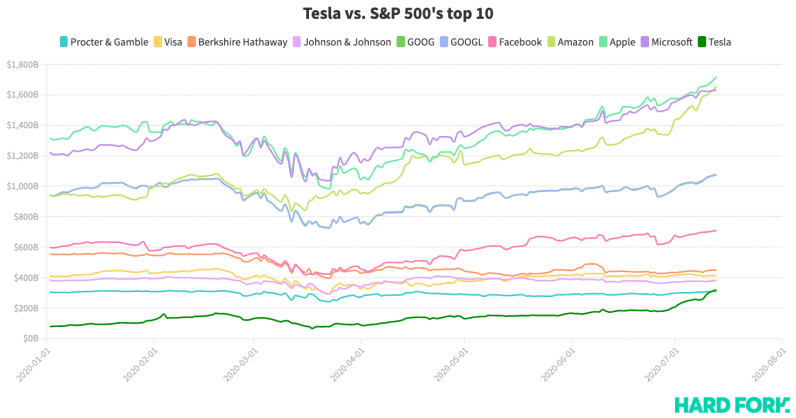

Now, not only is Elon Musk‘s electricity wunderstock absolutely the most valuable automaker in the world, but its $320 billion market value places it ahead of consumer goods giant Procter & Gamble, and inside the top 10 public companies in the US.

To say that Tesla has performed well this year is a serious understatement. After all, $TSLA started 2020 at $424.50, and it’s worth $1,733 at pixel time — a 310% increase in a little more than six months.

[Read: Watch Tesla’s meteoric rise — set to techno-remixed Elon Musk tweets]

But while Tesla has featured prominently in the tech-heavy NASDAQ 100 stock index since 2013, $TSLA is noticeably absent from the S&P 500; a wider set of US-listed stocks commonly used as a benchmark for the entire US market.

The real question is: How much does Tesla have to pump before it gets the S&P 500 nod? Well, Reuters asked an S&P spokesperson quite recently about that, but they refused to comment.

Something tells me that’s about to change.

Published July 13, 2020 — 16:44 UTC