Apple Pay Later appears to have left its early-access beta and to have fully launched in the United States for qualifying residents.

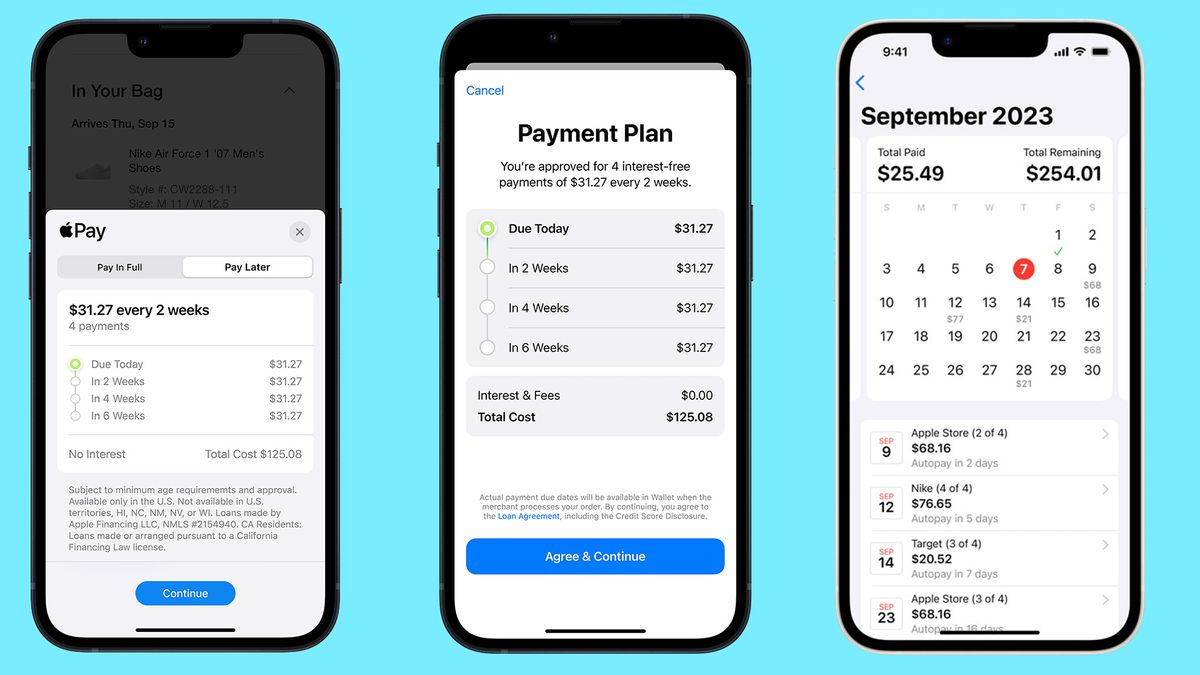

Pay Later is Apple’s in-house load program that lets customers borrow between $75 to $1,000 to purchase whatever they want while avoiding paying the full price up-front (the starting loan amount was originally $50 during the early-access period, but that’s been increased). This loan can be used on any site that supports Apple Pay, meaning it’s not just limited to buying Apple’s own devices or services.

Once the loan is granted, customers will then be able to pay it back that in four separate payments across six weeks without any worry of interest or fees. However, eligibility for Pay Later and the amount that can be borrowed is determined by a person’s credit rating.

Interestingly, Pay Later has got its full rollout ahead of an upcoming Apple event on October 30, in which we may see new Macs and the rumored Apple M3 chip. And the timing of Pay Later could coincide with Apple releasing new products and offering a means for people to buy them without making a single big payment.

Pay your way

Previously rolled out to a limited number of customers back in March, Apple has removed the line “Apple Pay Later is currently only available to customers invited to access a prerelease version” in its Pay Later support documents – as flagged by MacRumors.

Apple Pay Later is a little different to normal credit services as it forms part of the Wallet app on iPhone letting you tap into the service without going through a web browser as well as manage, track and view loan repayments.

What’s not clear yet is if Pay Later will be rolled out to other countries beyond the US, though it’s worth noting that in the UK, Apple has a partnership with Barclays that lets you buy an Apple divide and pay it back in a series of monthly payments with 0% interest over 24 months – I can vouch for this personally as I used it to buy a MacBook Air M2. Basically, it allowed me to get a higher spec model without needing to drop a big chunk of cash or pay any fees upfront. Of course, this is limited to buying Apple devices through the company’s website, but it’s a useful option when getting, say, a new iPad or iPhone.

Apple Pay Later could come in very handy over the next few week when the Black Friday deals really start gathering pace, letting you grab that one device you may have had your eye on for a bargain price and bypass on big payment.

You may also like

Services Marketplace – Listings, Bookings & Reviews