At this point, you probably know that you should use some sort of password manager to juggle all your logins across the web. Even if you don’t, you know you should. Now, 1Password wants to make virtual credit cards an easy obligation with a unique new program.

The popular password manager has announced a new partnership with Privacy.com that gives 1Password users the option to use virtual credit cards to protect themselves from fraud. After signing up and enabling the feature in the 1Password X Chrome extension, users will receive a prompt each time they try to make an online credit card purchase asking if they’d like to use a virtual card instead. The virtual cards create unique payment credentials for an individual service for one time use, or you can save a virtual card to continually use for payments on the service in the future.

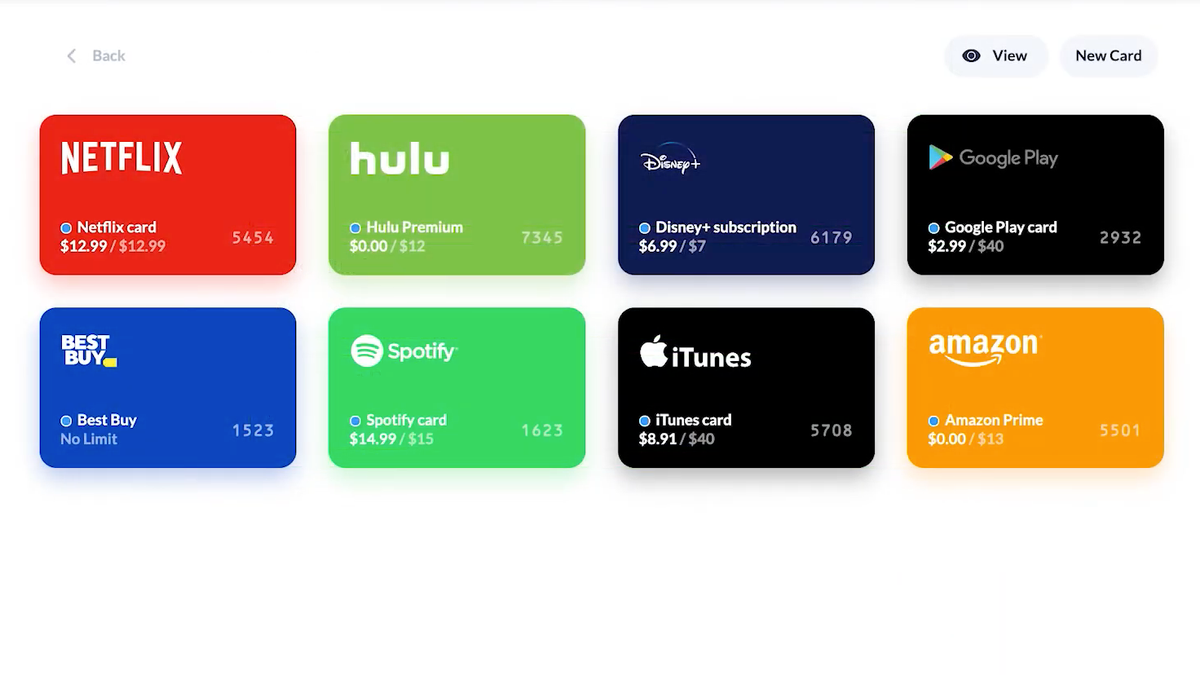

For example, a user can set up a virtual card to handle their monthly Spotify subscription renewal. 1Password’s extension will create a virtual card through Privacy.com’s system that will only pass along the virtual card’s information while your primary card is processed with your bank normally. The idea is that Privacy.com is operating like a password manager for your cards. The keys to your financial kingdom should stay safe in an encrypted format. And if Spotify suffers a data breach, there’s less of a need to freak out and go through the headache of setting up new payments for every dang thing you buy online. No one can take your Spotify card and head to Amazon to buy $2,000 worth of sneakers. Card details will be saved in 1Password for quick reference in the future.

Advertisement

Another thing that’s nice is you can set a spending limit on virtual cards. This gives an extra layer of security, but it could also be attractive to parents who’d like to load up some virtual cards for the kids.

This may be the first time that a password manager has taken a crack at moving into financial services, and we have to say the idea makes a good bit of sense. But like password managers themselves, there’s a hurdle to clear when it comes to familiarizing the public with the idea and getting people to adopt it. If it works, there’s a ton of profit to be made in payments.

G/O Media may get a commission

The system itself seems relatively easy once you get started, but unfortunately, you’ll need to sign up with two different services and set them up properly. They each have different pricing tiers and promotions running at the moment. Details on how to sign up can be found here and instructions for managing your virtual cards are here.