UK accountancy firm Crunch has announced Crunch Free, a new entry-level online accounting software package aimed at helping self-employed people who have been struggling as a result of the coronavirus pandemic.

A recent LSE study found that a fifth of the UK’s self-employed workforce thought about quitting altogether in August. So Brighton-based Crunch has unveiled the free-to-use version of their entry-level accounting software to help those struggling.

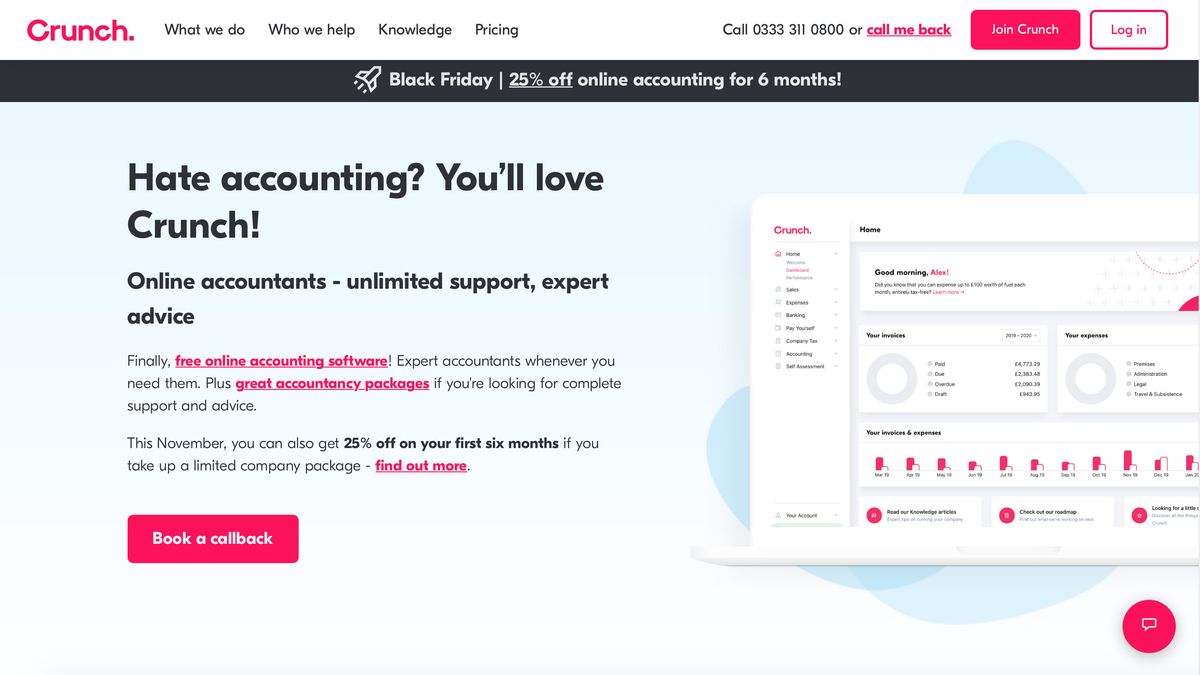

Although Crunch Free comes with no price tag attached it still packs in plenty of essential features for the likes of sole traders, who can make use of tools for creating, managing and updating invoices. The package also offers quick and easy expenses management on the go, thanks to its cloud-based infrastructure.

The company trialled a pilot period of the software last summer and the ready-to-go version now boasts an array of features, including Open Banking feeds that allow quick and easy importing of business transactions. There’s also receipt scanning to help with expenses management, plus intelligent bank reconciliation for keeping accurate tabs on cash flow.

Crunch Free

While the majority of Crunch Free features are complimentary, users will have the option of employing paid-for bolt-on services including an Ask the Accountant feature. For an additional fee, users can contact experts on the Crunch team, who can offer advice and support on a range of topics, from handling business finances through to becoming more tax-savvy.

“The COVID-19 pandemic has hit many freelancers and small businesses hard, and the support offered by the government, whilst welcome for those it supports, has left at least three million people unable to access government grants for their businesses,” said Darren Fell, Crunch founder and CEO.

“The world of work is changing for us all, and as more people start to be their own boss, we want to ensure that the new generation of self-employed workers are empowered to succeed at what they’re passionate about and love what they do.”