An AI analysis of New York City housing data has revealed stark racial disparities in homeownership, home loans, and foreclosures in the Big Apple.

The research by analytics giant SAS and the non-profit Center for NYC Neighborhoods (CNYCN) showed that areas with a higher proportion of Black and Hispanic homeowners have lower home values — even when the age and square footage of their properties are the same.

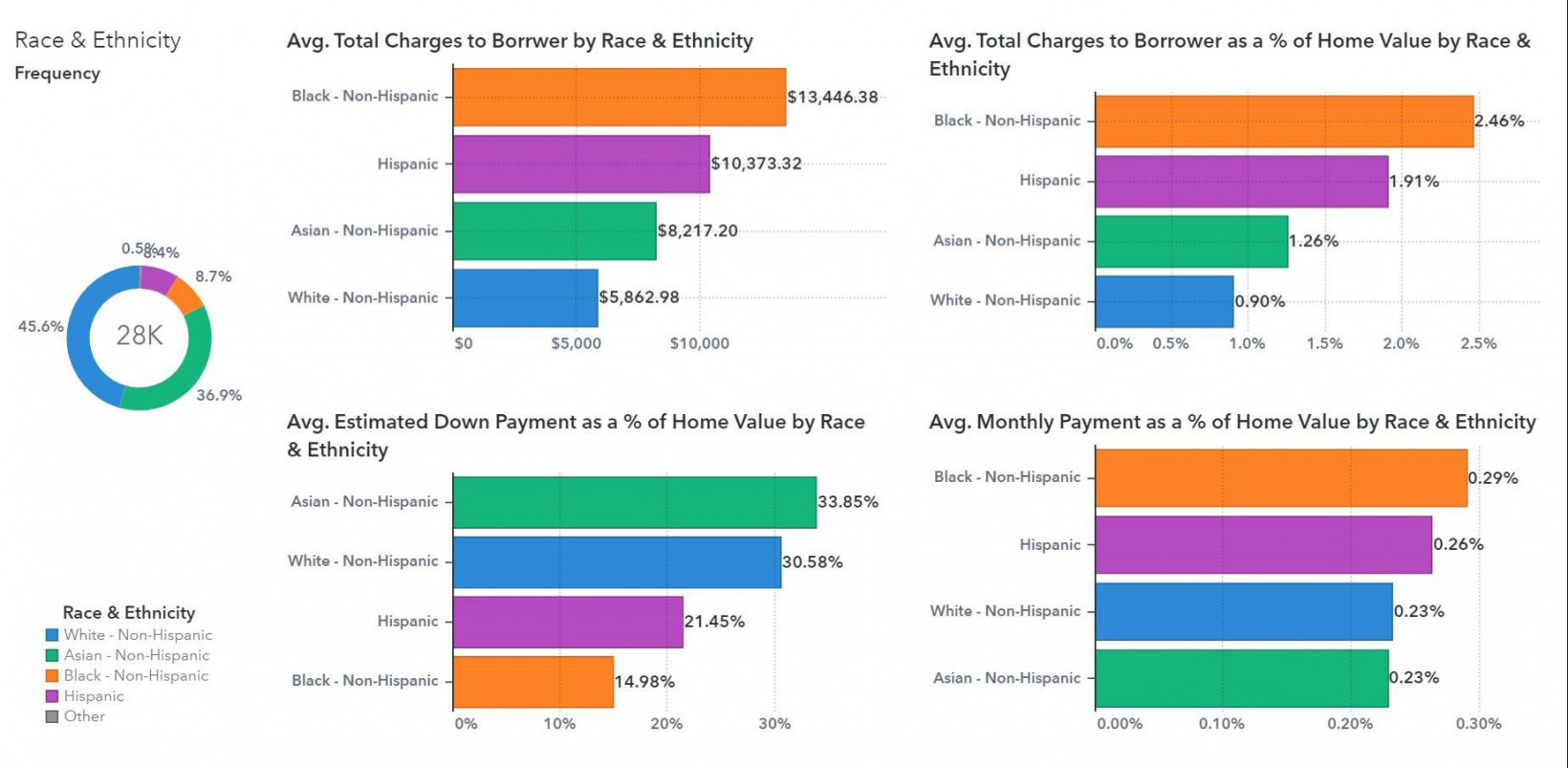

The team also found that the cost of getting home purchase loans is higher for Black and Hispanic borrowers than other racial groups.

The CNYCN will use the insights to design programs that can increase Black homeownership and advocate for policies that help to close the racial wealth gap.

[Read: How to build a search engine for criminal data]

The findings come amid an alarming drop in Black homeownership in New York City since the 2008 economic crisis. In Queens alone, more than 20,000 Black homeowners lost their homes between 2005 and 2017, according to a report from the CNYCN.

The non-profit believes that data-driven insights could help address the racial disparities in homeownership.

“While our findings do not automatically challenge the inequities we see in NYC neighborhoods, this exploration, hopefully, inspires new partnerships with financial institutions and other organizations with a wealth of data, including race, to revamp policies and correct bias in algorithms that determine things like home value and closing costs for Black communities,” said Ayana Littlejohn, an analytical consultant at SAS in a blog post.

Published November 30, 2020 — 18:33 UTC