J2 Global, parent company of popular tech sites PCMag and Mashable, is now the subject of multiple legal investigations following a tit-for-tat exchange with crew of short sellers that temporarily crashed its stock price.

On June 30, short selling outfit Hindenburg Research published a report that alleged J2’s “opaque approach” to acquiring companies “opened the door to egregious insider self-enrichment.”

The New York-based Hindenburg calculated J2 has acquired 186 businesses in its 25-year history, but its report drew particular attention to one deal: an undisclosed $900,000 paid to a J2 exec for an entity that had no employees or apparent assets.

[Read: Watch Tesla’s meteoric rise — set to techno-remixed Elon Musk tweets]

Hindenburg also claimed J2 recently committed $200 million in shareholder cash to a “newly-formed investment vehicle” operated by supposed company chairman Jeroen van der Weijden.

That investment vehicle’s first alleged move was $12 million to a supposedly dormant home video business established by van der Weijden’s nephew, sans the required conflict of interest disclosure.

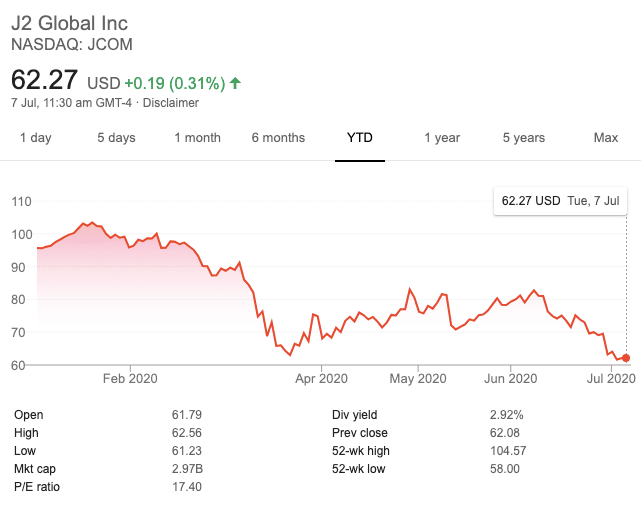

In total, Hindenburg says this and other acts like it have generated anywhere from $98 million to $128 million for J2 insiders. The company’s stock has fallen more than 10% since the report surfaced.

J2 Global says its under attack by a ‘short and distort’ outfit

J2 Global refuted Hindenburg’s report in full with a fiery press release published around a week later. “Attacks from ‘short and distort’ outfits like Hindenburg ordinarily would not be dignified with a response,” said the company.

“However, the attempted impugning of J2’s integrity and ethics required a clear and thorough refutation of Hindenburg’s baseless allegations and disparaging misrepresentations,” continued J2.

In particular, J2 maintained that van der Weijden was not an “employee, director, or significant shareholder” in the company at the time of the $900,000 acquisition in question.

However, J2 mentioned that van der Weijden had served as a consultant from 2004 until 2014. “Moreover, Mr. van der Weijden was never an executive officer of J2 so the reporting of this immaterial transaction was never required,” said the company.

Strangely, finance portal MarketWatch found van der Weijden listed as a director of J2 Global UK (a subsidiary) from June 13, 2014, to Jan 12, 2016 — effectively invalidating J2’s rebuttal.

Hindenburg makes money when its target goes down

It’s a curious story, albeit murky.

On one hand, Hindenburg’s research should be taken with a grain of salt, considering their very real monetary stake in the matter.

But as influential law firm Hagens Berman highlighted, similar allegations have been levied against J2 in the past. Glasshouse Research published a forensic report in December 2018 that threw doubts on J2’s acquisition accounting — just like Hindenburg’s.

Back then, Glasshouse analysts labeled J2’s accounting system suspect: “Management has touted many farce operating metrics that do not show J2’s true economic value,” they said.

As such, Hagens Berman says it’s opened an investigation into potential securities fraud, calling on J2 shareholders to submit their losses. It also urged company whistleblowers to come forward. Hagens Berman notably defended Enron employees who’d found their retirement funds wiped out in its collapse, among other high profile cases.

More than a dozen firms have recently issued similar statements, namely: Bragar Eagel and Squire; Brock and Leviton; Broinstein; Gerwitz & Grossman; Faruqi & Faruqi; Frank R Cruz; Glancy Prognay and Murray; Howard G Smith; Jonhson Fistel; Kirby McInerney; Labaton Sucharow; Lowey Dannenberg; Pomerantz; Rosen; and Schall.

Hard Fork has reached out to J2 Global for a statement on the matter, and will update this piece should we learn more.

For what it’s worth, a similar story played out earlier this year, when Hindenburg claimed web browser Opera was engaged in predatory lending practices in Africa. Opera stock dropped 18% on the same day that report was published.

Opera refuted Hindenburg’s claims, reportedly labeling its findings full of “unsubstantiated statements, numerous errors, and misleading conclusions regarding our business and events related to Opera” — and just like the current J2 situation, a raft of law firms issued press releases in the days following, effectively squabbling over the mere potentiality of securities fraud windfall.

Published July 7, 2020 — 16:36 UTC