If you hadn’t heard about Nikola, the startup that’s developing electric and hydrogen powered trucks, it recently went public and is now valued at more than Ford, despite having no product. Here’s the lowdown.

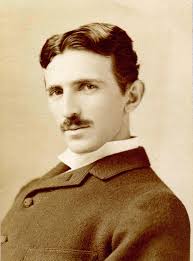

Before we get started, yes, like another electric vehicle maker Nikola is named after a certain Serbian-American inventor of the same name, Nikola Tesla to be exact. That parallel to Tesla is going to crop up on more than one occasion too, so take note.

Nikola was founded in 2014, guided by the dream of electrifying semi-articulated trucks with hydrogen fuel cells and hybrid drivetrains. In many ways, the company positioned itself as the Tesla of commercial haulage vehicles.

[Read: The upcoming all-electric BMW iX3 is a sign the industry is truly changing]

Despite showing a fairly comprehensive product lineup on its website, the company is yet to actually produce anything. Last year, Nikola closed a deal and acquired nearly 400 acres of land in Arizona to start building its truck factory. The company said it expects to start building the facility this year, with trucks entering production soon after in 2021.

Nikola’s founder, Trevor Milton, said the company should be able to turn out somewhere between 35,000 and 50,000 trucks a year. While the company has reportedly generated over 14,000 orders for its hydrogen fuel cell trucks, these are non-binding orders and shouldn’t be considered as anything more than a statement of interest.

A recent BBC report said the company has more than $10 billion worth of pre-orders waiting to be fulfilled.

A noble vision

It’s not surprising the company has drummed up substantial interest, though. Behind passenger cars, mid to heavy trucks make up the second most polluting group of vehicles on the roads in the US. In the journey to cleaning up our roads, trucks are a significant part of the puzzle.

But so far, none of them exist, and Nikola has a long way to go to make them a profitable reality.

In recent weeks the company has made headlines again, this time for two reasons: it’s just started taking orders for its hydrogen fuel cell and battery electric hybrid vehicle, the Badger, and for getting publicly listed on tech stock exchange NASDAQ. But there’s more here than meets the eye.

Despite reports that Nikola IPO’d, there’s a bit more to it than that. Yes, the company went public last week, but it did so through a reverse merger — a strategy that is typically used to help a private company go public without having to undertake a costly and totally new IPO.

Back in March, Nikola announced a merger with VectoIQ, Green Car Congress reported. VectoIQ is what is known as a “special purpose acquisition company;” it’s a publicly traded entity set up with the sole purpose of merging with another similar business within 24 months of its own IPO.

Despite being nothing more than a shell corporation, VectoIQ has traded on the NASDAQ since May 2018. Following the reverse takeover with Nikola, its stock ticker changed from VTIQ to NKLA. According to Investopedia, this is common practice for this kind of takeover.

Nikola versus Ford

This merger ended up making both Nikola and its founder, Trevor Milton, a ton of money. So much that NKLA’s market cap is now slightly larger than Ford and Fiat Chrysler Automotive.

For some perspective, Ford sold over 5.5 million vehicles in 2019 and has a market cap of around $28.8 billion. Ford is also expected to report over $115 billion in revenue this year, whereas Nikola has sold nothing, and is valued at over $30 billion, WSJ reports. That makes Nikola the world’s biggest truck maker that’s never actually made or sold a single truck.

While new companies may take a while to turn a profit, Nikola has been around a while now, and is still not projecting to make any profits until it’s started production, which won’t happen until at least next year. It’s worth noting, Tesla has been selling vehicles for years, and is still yet to return a consistent profit.

Milton is also reportedly the world’s 188th wealthiest individual as a result of the merger.

What’s more, Milton seems more keen to flex on his company’s value and emulate Elon Musk, than talk about his firm’s tangible successes. That said, aspiring to be directly accessible on Twittesiter will hopefully be a good thing, so long as he continues to respond to customers rather than hyping up business.

I’ve wanted to say this my whole adult life; $NKLA is now worth more than Ford and FCA. Nipping on the heels of GM. It may go up or down and that’s life but I’ll do my part to be the most accessible and direct executive on Twitter. Others will follow.

— Trevor Milton (@nikolatrevor) June 9, 2020

Following the company’s public listing, Milton went on to tweet — a la Musk — that his company would start accepting pre-orders for their electric pickup truck, the Badger.

After the announcement, NKLA shares rocketed 104% in its third day of trading, Bloomberg reports. At the time of the merger, VectoIQ shares were trading at around $35, by Tuesday they’d hit a high of around $93 per share.

Like Tesla, Nikola is attracting a fair share of short sellers — people who are betting on the company failing. According to figures cited by Bloomberg, bets against Nikola have reached a peak of over 20% of the public shares.

It’s not Tesla, it’s Nikola

While the Nikola lineup of semi trucks take aim at Tesla‘s Semi, the Badger shoots right across the bow of Tesla‘s Cybertruck. It’ll also have a wily competitor in the upcoming all-electric Hummer.

Reservation holders will have first dibs on #nikolaworld2020 tickets. Sign up here to be notified immediately when #nikolabadger reservations open on June 29th. https://t.co/VfRevYYrIt

— Trevor Milton (@nikolatrevor) June 8, 2020

What makes the Badger unique is that it will be a hybrid vehicle with zero emissions. Where a conventional hybrid blends a combustion engine with an electric motor, the Badger will blend a hydrogen fuel cell with a high-capacity battery electric drivetrain.

[Read: EV startup Nikola takes on the Tesla Cybertruck with hydrogen-powered ‘Badger’]

For long-distance adventuring this is a theoretical boon. With a claimed range of 600 miles (around 1,000 km) and the option of running on batteries and hydrogen it gives a flexibility that other all-electric pickup trucks lack.

The only downside is the lack of hydrogen filling station infrastructure, which the company acknowledges and says it’s trying to change. But it’s not going to build any stations like Tesla did with its Supercharger network, Nikola is just going to push for adoption and support — whatever that means.

No product, no profit

That’s a lot to take in for a company that has thus far flown under the mainstream radar. So here’s a recap:

Nikola is now trading on the NASDAQ under NKLA after undertaking a reverse merger. Speculative investors have gone crazy after the company’s founder followed in Elon Musk’s footsteps by hyping his product on Twitter. Not everyone is so sure about the company, and it’s attracted a notable number of short sellers. Naturally, the company is drawing strong comparisons to Tesla.

Nikola is now taking pre-orders for its pickup truck that doesn’t exist, aren’t in production, and are at this moment, mostly just cool concepts. The company isn’t expecting to make a profit anytime soon.

Additional reporting by David Canellis

Read next: Quibi’s app is slowly improving — but is the world ready for it?

Corona coverage

Read our daily coverage on how the tech industry is responding to the coronavirus and subscribe to our weekly newsletter Coronavirus in Context.

For tips and tricks on working remotely, check out our Growth Quarters articles here or follow us on Twitter.