Despite a year-long pandemic in which Americans were asked to stay indoors, gun violence is on the rise in the United States. In 2020, almost 20,000 Americans died by gun violence, according to the nonprofit Gun Violence Archive (this number doesn’t include self-inflicted gun violence). The organization has already reported more than a hundred mass shootings in 2021with seven of them happening in the span of just seven days, CNN reports.

Activists and legislators are pushing for stronger gun legislation, and advocates have called for additional solutions to address gun violence through mental health resources and decreased police presence in neighborhoods. But you might not know of another way you can make an impact: your retirement investments. Stock holdings in gun companies are extremely common, and, if you’re not looking closely, might slip into your retirement portfolios. Moving your money away from these holdings can make a difference in the fight to change the way guns are purchased and distributed in this country.

Andrew Behar is the CEO of the nonprofit As You Sow, a watchdog and investor advocacy group that provides resources for those interested in more socially responsible investing. As You Sow’s Invest Your Values tool helps investors rate and reference where their money is going, and covers a wide range of topics: environmentally-friendly investing, gender equality funds, prison-free funds, and gun and other weapon-free funds.

Behar says that his organization’s inclusion of gun-free funds, specifically those that contribute to civilian firearms, was inspired by the outrage after the 2019 shooting at a Walmart in El Paso, which ignited a conversation about gun retailers and open-carry laws after 20 people were murdered. “The whole thing started out of necessity… We discovered that nobody knew what they owned. It was a revelation to us: What is actually in my 401(k)?” Behar says. When looking at the thousands of funds included in major retirement plans, Behar realized how frequently gun manufacturers and retailers appeared: “It was an introduction to just how complicit I was in owning a piece of this destructive economy.”

“We discovered that nobody knew what they owned. It was a revelation to us: What is actually in my 401(k)?”

With online tools, some personal research, and the help of coworkers, socially responsible investors can screen their own funds and divest from companies contributing to the growing arms industry.

1. Evaluate your retirement options

Most investment options offered by employers take the form of a 401(k) built out of mutual funds. A mutual fund is a collection of stocks, bonds, or company holdings that have multiple contributors (you and your coworkers, among many others). You might alternatively invest through an Exchange Trade Fund (ETF), which is a similar collection of hundreds or even thousands of stocks traded together. Or investors may use an individual savings plan not connected to their work — things like Roth IRAs, solo 401(k) plans, or other personal portfolios. In any of these forms, you are investing in the success of companies, which could be (either directly or indirectly) involved in the arms industry.

For more information on the various investment options, check out Mashable’s explanation of how your investments can help the environment or NerdWallet’s in-depth guide to different investment accounts.

Your employer may offer you a 401 (k) plan through an investment firm like Vanguard, Fidelity, or Blackrock. Many people choose 401(k) plans with a target date of their retirement age, but have no idea what’s in those funds. Your employer may also limit which target-date funds you can invest in as part of your 401 (k) plan, further restricting your options. Individually managed, personal portfolios like IRAs, or self-employment options like individual 401(k)s, will offer you the most control over your fund options as opposed to the constraints you may find with 401 (k) target-date funds offered by an employer, Behar says.

If you’re starting a personal portfolio, you’ll want to look for explicitly gun-free funds or socially responsible investing (SRI) options that include gun-free screens. These might also be in the form of what are called ESG funds, which focus on investing in companies that commit to certain environmental, social, and governance standards.

If you are locked into keeping your investments in a company retirement plan like a 401(k) due to tax reasons, you can still be proactive about keeping them as gun-free as possible or request your employer add gun-free options. More on that later.

2. Know how weapons manifest in your investments

When you choose to invest in funds built out of dozens (possibly hundred or thousands) of company holdings, you could be contributing to the arms industry in a multitude of ways, including various sectors of the industry:

A typical, diverse portfolio probably has holdings in many of these areas. Larger plans, like S&P 500 funds, might not have holdings directly in gun-related companies, but many still have ties to weapons stocks. Behar says As You Sow found at least 18 weapons companies connected to the S&P 500 fund.

Behar explains that these investing “layers”— and the convoluted hierarchy of retirement fund managers within an investor’s company itself — leave many confused about what their money is supporting. “In your U.S. 401(k) plan, you own a part of these companies because a fund manager thought they would make big bucks. Many activists and advocates don’t know they’re investing in these funds,” Behar says.

But while fund managers might explain the presence of gun stock holdings as a good return on your investments, they aren’t actually guaranteed financial performers. Forbes reported in March that while gun sales have increased in 2021, gun stocks themselves haven’t seen any growth.

And, regardless of financial gains, Behar says investors have the right to know what industries their money is invested in. “It’s about transparency, knowing what you own… Data leads to change,” he says.

3. Screen your funds

Now is the time to look at your account itself. Your investments are probably connected fund families — a collection of funds (mutual funds, ETFs, etc.) all managed by one investment company. An employer will typically offer you the choice of funds within a family like Fidelity, Vanguard, or American Shares.

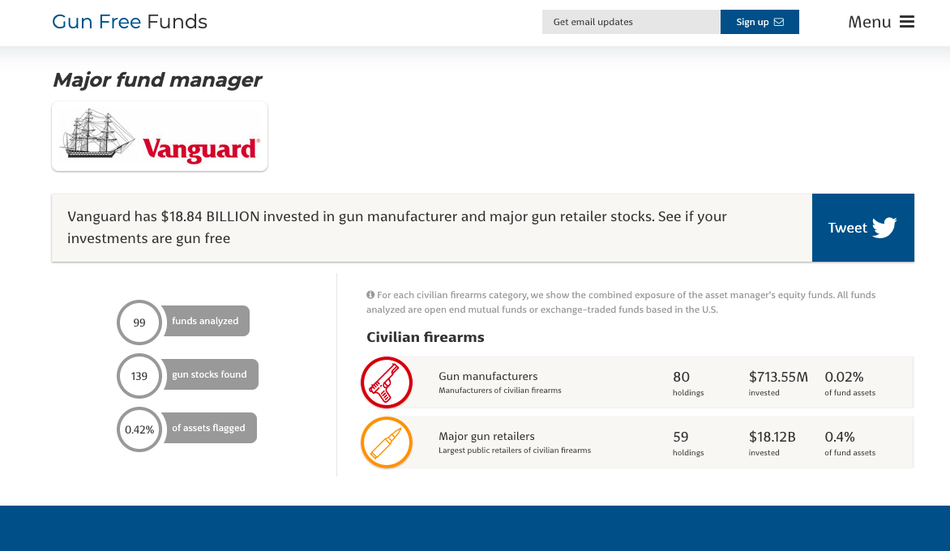

As You Sow publishes data on fund families across more than 100 managers, including Vanguard, Fidelity, and Blackrock, providing information on total investments and stock holdings in both gun manufacturers and gun retailers, from gun-only retailers to big box stores like Walmart.

As one example, As You Sow found that across the family of 99 Vanguard funds it analyzed, more than $18 billion is invested in gun manufacturers and retail. It has one of the lowest overall scores for fund families on the list, meaning that many of its funds are tied up in gun investments.

That doesn’t mean every fund in the family is “bad,” though. Many individual mutual funds on Vanguard’s list have zero stockholdings in gun manufacturers and get “A” ratings from the nonprofit. Use the overall rating for a fund family as the starting point for finding managers and fund families that are committed to gun-free holdings.

Also, some of these managers have rolled out new gun-free investment options. In 2019, after the Marjory Stoneman Douglas High School shooting, Blackrock announced two new ETF choices that screen out civilian firearms. And Vanguard began including gun-free screens in a few of its ESG fund offerings.

Vanguard funds invest more than $18 billion in both gun manufacturing and retail.

Image: screenshot: as you sow

You might also be investing in index funds, which are curated portfolios of a select set of stocks and bonds available to investors. This “passive” form of investing is fairly common and simple, but you once again run the risk of not knowing exactly where your money is going. Check As You Sow’s score of the top 10 index funds or search for your index fund online.

You can also search through As You Sow’s general gun-free funds list, which includes mutual funds and ETFs, to find your investment’s rating or peruse the top gun-free funds.

The gun-free funds database gives each fund a letter grade based on its contributions and stock holdings

Image: screenshot: as you sow

Investors may want to cross reference their fund’s investments with the Stockholm International Peace Research Institute (SIPRI), an international research organization that researches disarmament, arms sales, and arms control. The organization’s Arms Industry Database tracks the top international arms producers and military service companies. According to its 2020 report, the top five gun manufacturers are all U.S.-based companies: Lockheed Martin, Boeing, Northrop Grumman, Raytheon, and General Dynamics. Check your investment funds for holdings in these companies.

Some asset managers have added gun-free screens to their own databases as well. Search through holdings in Vanguard fund families on its website to find explicit gun stock holdings. You may need to know the stock name or ticker number for the companies you would like to divest from — find those on websites like Marketwatch or Stockcharts.

The ticker symbols for the top five weapons manufacturers according to SIPRI are:

-

LMT (Lockheed Martin)

-

BA (Boeing)

-

NOC (Northrop Grumman)

-

RTX (Raytheon)

-

GD (General Dynamics)

Other U.S. companies include Vista Outdoor (VSTO), Sturm Ruger (RGR), Smith & Wesson Brands (SWBI), and AMMO (POWW). Morningstar also has a guide to finding gun manufacturers in your index fund investments and stock portfolios.

You might want to take note of whether or not your investments are screened for all munitions, including military contracts, or just civilian firearms — figure out which category you’d like to prioritize or include both in your search criteria. As You Sow’s Weapon Free Funds site includes both screens, while Gun Free Funds aggregates civilian weapon connections.

If you can’t find your fund in the database or need help screening the many stocks and holding in your fund, ask your asset manager for a breakdown of your investments or contact an external financial advisor to help.

4. Reach out to your employer

Now that you’ve evaluated a fund’s ratings, it’s time to move your money around. This process might happen incrementally; in most cases, some funds in your 401(k) will be better than others, Behar says. You may not have perfect options to begin with, but you can move your investments over to the better scoring funds (think a “C” rating or higher) while you wait for options that get green scores.

Shifting your investments is something you can easily do online. Contact your fund manager, a company representative, or an outside investment advisor for guidance.

If your employer doesn’t offer gun-free funds or if all your options fail the screening process, ask to expand your offerings. It’s much easier for an employer to add more options than change the funds themselves, Behar says. And it might be beneficial to enlist the help of other employees to persuade your employer to add more options. As You Sow recommends forming a coalition of employees to share fund ratings and performance data with your employer, or file shareholder resolutions if needed.

The nonprofit’s Action Tool Kit includes three other considerations when approaching your employer:

-

Contact (or create) a company “corporate responsibility team” focused specifically on weapon or gun-free investing.

-

Find the right person to speak to: either a plan administrator, chief corporate responsibility officer, or employee engagement manager.

-

Come prepared with information and questions. A good place to start these conversations is with a clear, focused statement: “We want to reduce the future risk of our 401(k) fund choices. We also want to invest in a peaceful future. How can we enhance our 401(k) choices to do so?”

Behar says that you should check back in with your fund manager after three months, but changes to fund options could take up to a year. And if you are met with direct resistance, start a petition. The Action Tool Kit includes a sample letter to plan administrators, or interested coalitions can contact As You Sow directly for assistance.

5. Follow the votes

Remember that your investment options aren’t just arbitrarily decided — individuals, most likely from your asset manager or company management, choose what you invest in, and where your employer’s financial priorities lie, through a process called proxy voting. These are votes on behalf of the shareholders (you) and they decide fund options, stocks, and more for mutual fund investors.

Make sure your money is aligning with your values by tracking the way your asset managers, fund managers, or other stock holders use their proxy votes. When fund managers choose to vote for companies that abide by socially responsible investing, including gun-free companies, they have the power to influence corporate decisions.

Behar says investors have the right to ask that proxy vote decisions are made more transparent to investors. The current acting chairwoman of the Securities and Exchange Commission (SEC), Allison Herren Lee, even voiced her intent to have asset managers disclose their votes to the SEC, out of concern that these powerful representatives are failing to uphold their commitments to socially responsible investing.

Most funds publish votes from the previous year on their websites. You can also find voting information on the SEC’s EDGAR Database, but this information is limited to current disclosure laws. Keep up voting conversations with your fund managers throughout the year, even after the voting period. Behar says to ask whether or not decision makers are taking into account the concerns (and values) of shareholders, or are just making decisions based on financial performance. “Are they voting with the interests of managers or are they voting along with shareholder advocacy?”

Making it clear that employee values should be a consideration in investment matters is the first step in creating a company culture that is open and progressive, Behar says. And, with billions of workplace dollars going toward gun stocks, this commitment to more socially responsible investing has repercussions beyond the workplace.