The advent of coronavirus vaccines has reshuffled global markets.

Travel stocks are staging long-awaited comebacks, and ‘stay-at-home’ faithfuls like Zoom and Amazon are struggling to maintain their share prices in a potential post-COVID world.

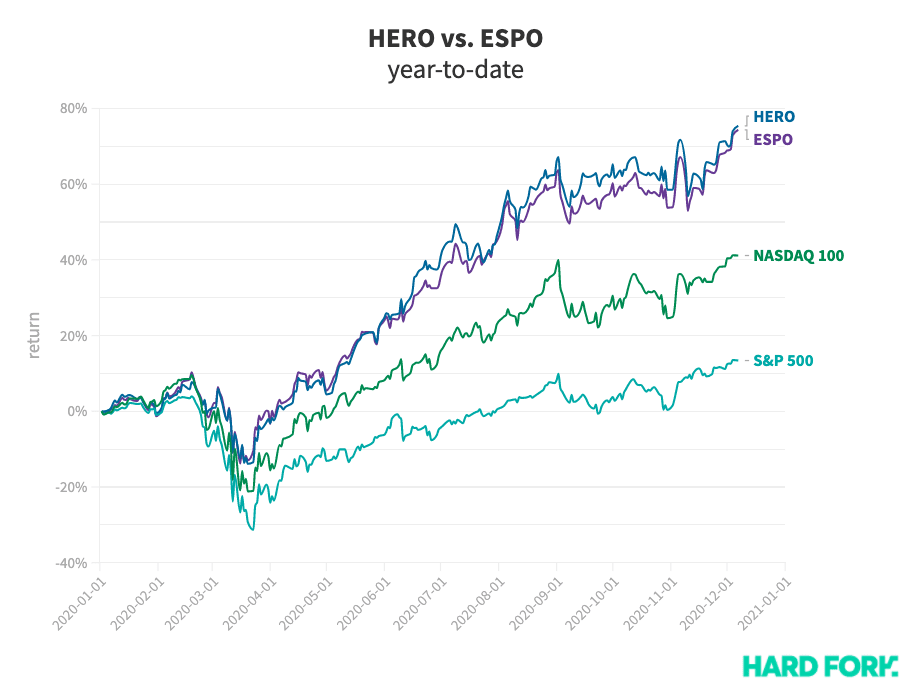

But esports and gaming stocks seem impervious to the noise. HERO and ESPO, the market’s biggest gaming Exchange Traded Funds (ETFs), are now trading at record highs.

Both stocks are up around 75% year-to-date, far beyond the tech-heavy NASDAQ 100 and the broader S&P 500 market indices.

Unlike Moderna (which suddenly boomed once news of its successful trials broke), our gaming ETFs have practically surged non-stop since the market bottomed out in March.

However, their latest price records come almost in unison with new all-time highs set by the S&P 500 and the Dow Jones Industrial Average.

ESPO and HERO’s big esports bets proved strong in 2020

ETFs offer investors exposure to an underlying portfolio of stocks, and the total value of those assets mostly dictate their share prices.

They usually facilitate investment in an entire sector, with most of the ETFs on the market tied to an automated index of stocks, as is the case with both ESPO and HERO.

And so, the record highs enjoyed by both ETFs can be attributed to stellar performances from their largest bets, namely China’s Tencent, graphics guru NVIDIA, and Singaporean mobile prince Sea, which have returned 52%, 128%, and 390% year-to-date.

(If the visualization above doesn’t show, try reloading this page in your browser’s “Desktop Mode.”)

Together, they make up around 20% of the $1.17 billion in assets managed by both funds.

Enter Bitcoin

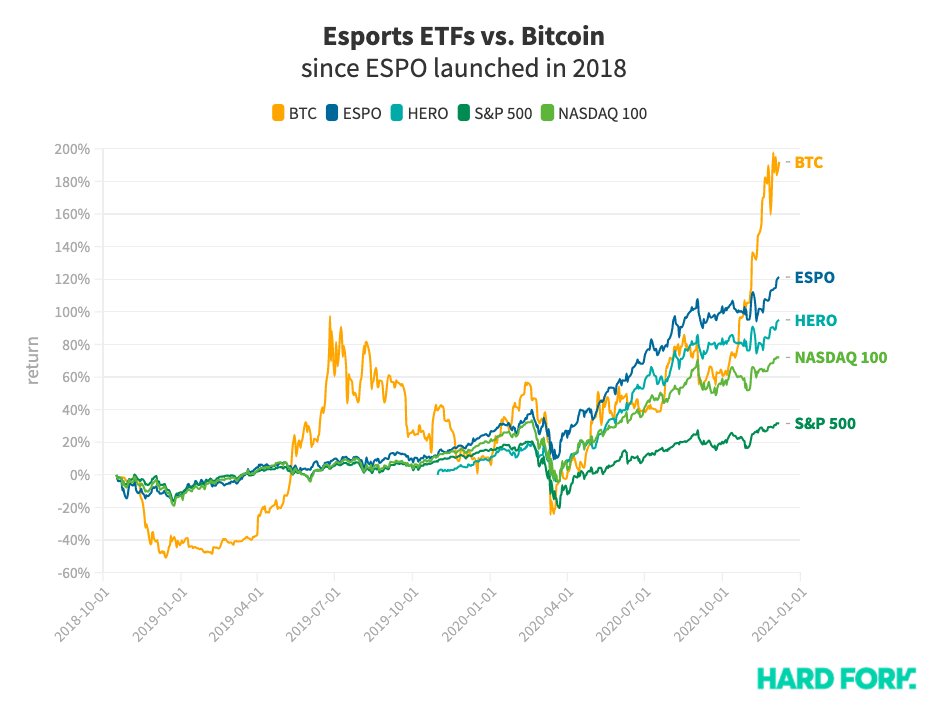

Still, no matter how hard gaming and esports ETFs might rally, they’re no match for Bitcoin.

Indeed, not only has BTC now outperformed both ESPO and HERO this year, but it’s returned significantly more since ESPO first launched back in 2018.

That wasn’t always the case. Back in October, Hard Fork reported both funds had beaten Bitcoin over the year.

Well, that was before BTC pumped 80% in a few short weeks, from around $10,600 to $19,200 today.

What a difference one bull run makes.

None of this is investment advice, so don’t pretend it is. Don’t invest your money based on a single article on the internet. Do your own research.

Published December 7, 2020 — 16:44 UTC