PayPal has been granted a full BitLicense from the New York Department of Financial Services, the company announced in a press release. This makes PayPal the first company to trade in a conditional BitLicense for the real thing.

New York introduced its BitLicense in 2015 as a way to regulate businesses that provide customers with the ability to buy and sell cryptocurrency in the state. However, some crypto advocates criticized the policy, stating it could potentially make it harder for businesses to get involved in crypto. In 2020, New York launched a proposed conditional BitLicense in response, a supposedly more streamlined process for obtaining the documentation.

“The conditional license is now a proven framework for licensure”

Companies are encouraged to get a full BitLicense, however, as guidelines indicate that businesses with the conditional license “will endeavor to eventually seek and obtain a full BitLicense.” PayPal seems to have followed this suggested path, as it was granted a conditional BitLicense in 2020 before getting its full license two years after.

“The conditional virtual currency license allows businesses to have well-regulated access to the New York marketplace through partnerships with licensed firms, ensuring that New Yorkers have access to a wide variety of virtual currency products with appropriate consumer protections,” New York’s DFS Superintendent Adrienne Harris said in an emailed statement to The Verge. “With PayPal’s conversion to a BitLicense, the conditional license is now a proven framework for licensure.”

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23614912/paypal_transfer_crypto_wallet.jpeg)

Andrea Donkor the SVP of regulator and customer compliance at PayPal told The Verge that the “future of safe and responsible innovation in crypto requires strong partnership between regulators and industry.” A partnership with the NYFDS has been “critical” in helping PayPal “provide greater inclusion and access” to customers, Donkor explained.

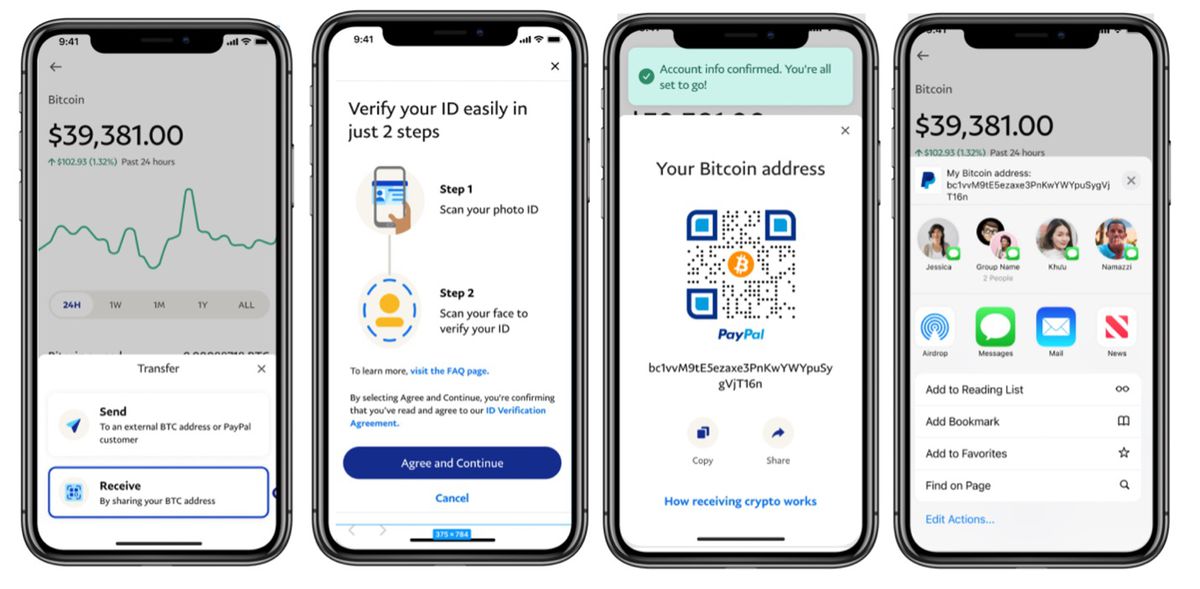

In addition to announcing its BitLicense approval, PayPal is also rolling out several new ways for customers to interact with crypto on the platform. Select users in the US (excluding Hawaii) now have the ability to transfer supported cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, and Litecoin, into PayPal, as well as move crypto to external wallets and exchanges. PayPal also says users can send crypto to friends and family members through PayPal “with no fees or network charges.” These features will be available to more users in the US in “the coming weeks.”

PayPal first started letting users buy and sell cryptocurrencies in 2020 — around the same time it obtained its conditional BitLicense. It later expanded the functionality last year, adding the ability for users to pay with Bitcoin, Litecoin, and Ethereum. The PayPal-owned Venmo also started supporting cryptocurrency last year.