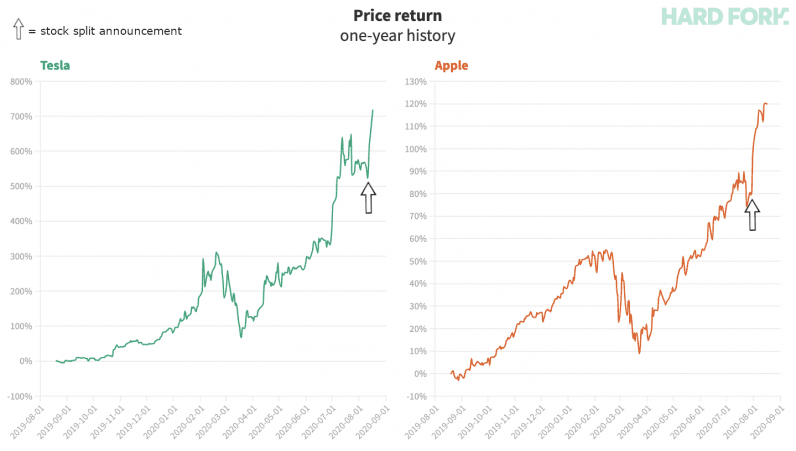

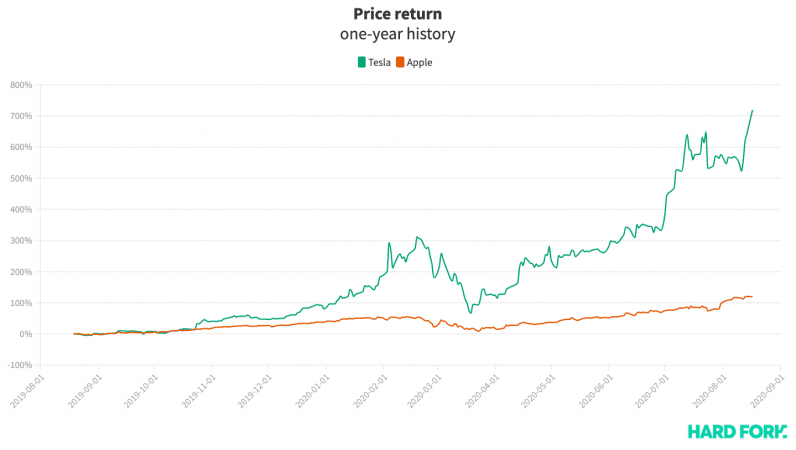

It’s hard to find better-performing stocks than Tesla and Apple. Tesla, now the world’s most valuable automaker, has seen its share price multiply eight times since this time last year, from $224 to beyond $1,800, while Apple’s more than doubled to $458.

And so, in a bid to make individual shares more affordable, both tech giants announced they’d be “splitting” their stocks later this month.

But, traders have recently pumped both companies’ shares; Tesla’s stock surged more than 30% in the six days following its split reveal, and Apple’s is up 24%.

As a result, Tesla added $85.8 billion to its market value while Apple’s grew by $318.6 billion.

The stock splits will work like this: Tesla stockholders will have their share count multiplied by five (5-to-1 split) on August 28, but the underlying value of their investment will not change.

This means Tesla’s stock price will effectively divide by five at the time of the stock split. If $TSLA is worth $1,800 before, its split-adjusted trade price will be $360 just after, the idea being that investors would find lower share prices more compelling.

On the other hand, Apple opted for a 4-for-1 split on August 31.

Are Tesla and Apple buyers really just here for the stock splits?

The thing is, it’s difficult to say just how many buyers either company has attracted simply through the promise of increased share counts.

[Read: Watch Tesla’s meteoric rise — set to techno-remixed Elon Musk tweets]

Revenue, profits, and other boring (but necessary) factors could just as likely have had positive effects on Apple and Tesla’s share prices.

Apple even disclosed its stock split inside its stronger-than-anticipated quarterly earnings call, making it even harder to tell.

For what it’s worth, the brainiacs over at Columbia University investigated the suspected link between stock splits and share price a few years ago, but found little connection.

Instead, they found that analysts tend to increase their earnings expectations around the time that stock splits are announced, which leads to more interest from investors.

While it is possible that managers split their stock to cater to investors that prefer low-priced stocks during certain periods, or attract more uninformed investors to their stock, our results indicate that the market’s reaction to split announcements is not likely to be driven by a response to these managerial motives.

Our new evidence supports the hypothesis that while managers often state various motivations for splitting their stock, the market’s reaction to stock split announcements is likely driven by information related to the firm’s earnings, which the market infers from the split announcement and views as favorable news. An earnings information hypothesis therefore warrants renewed attention as an explanation for the market’s reaction to stock split announcements.

In any case, Columbia’s research hasn’t stopped analyst speculation as to which major company will be next to split their stock.

Amazon is one likely candidate. The ecommerce giant hasn’t issued a stock split since 1999 — before the dot-com bubble burst — during which time its share price has risen from $60 to $3,182.

Published August 18, 2020 — 13:14 UTC