It’s well documented that tech insiders have made veritable oceans of money in 2020, but it’s tough to find any who’ve benefitted nearly as much as Zoom’s chief Eric Yuan.

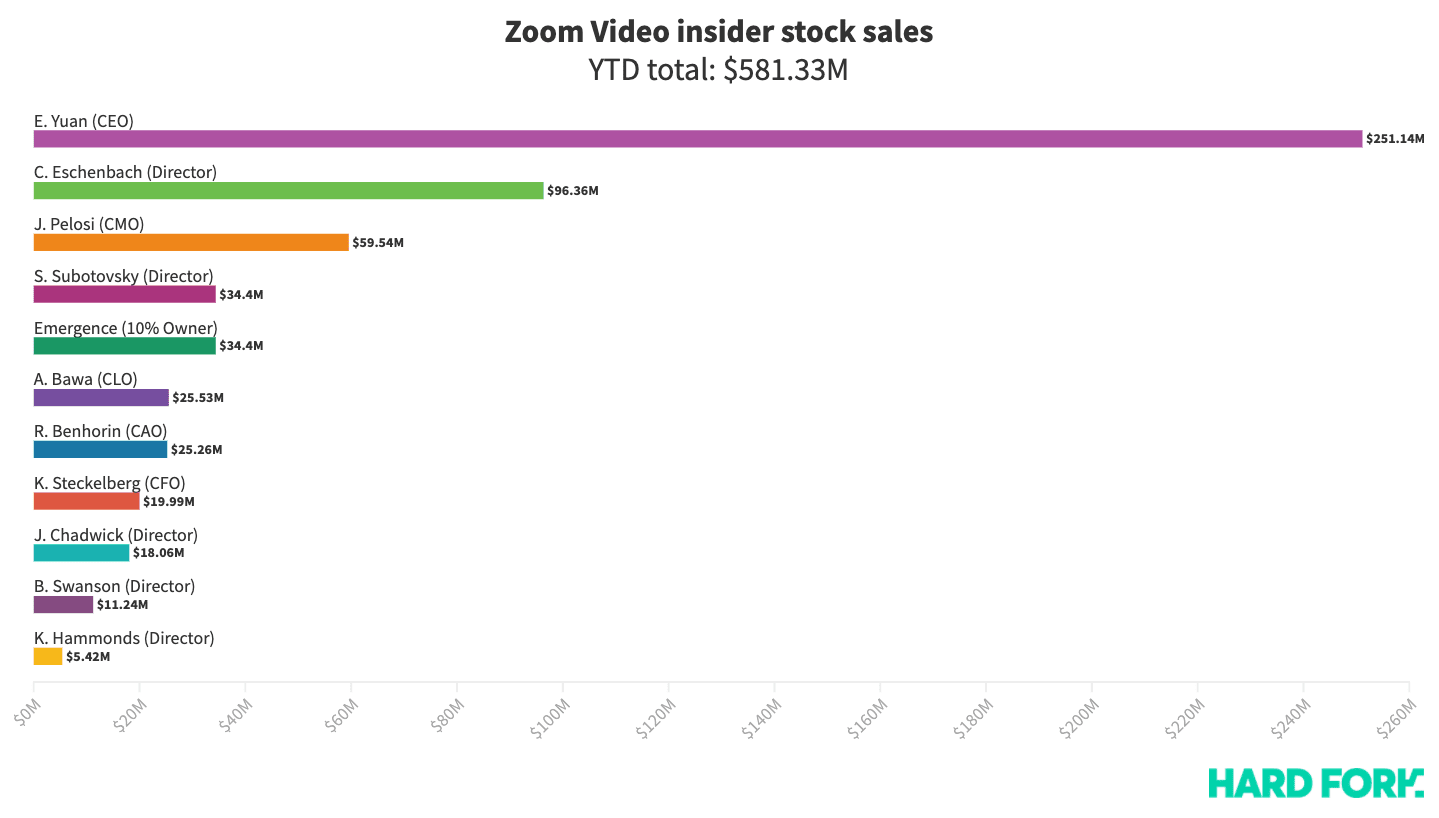

Last week, Yuan sold $69.3 million worth of company shares to bring the total sum of cash raised by Zoom insiders this year to a tendon-twisting $581.33 million — more than half a billion dollars split between just 10 execs (and one fund).

Yuan leads the video conferencing company’s 2020 leaderboard for stock dumps with $251 million, representing nearly half of all Zoom insider sales this year.

Next is company director Carl Eschenbach, a partner at influential VC fund Sequoia Capital who’s made $96.36 million by selling Zoom shares, followed by the company’s chief marketing officer Janine Pelosi with $59.45 million.

Compared to Bezos, Zoom’s insider dumps are rookie numbers

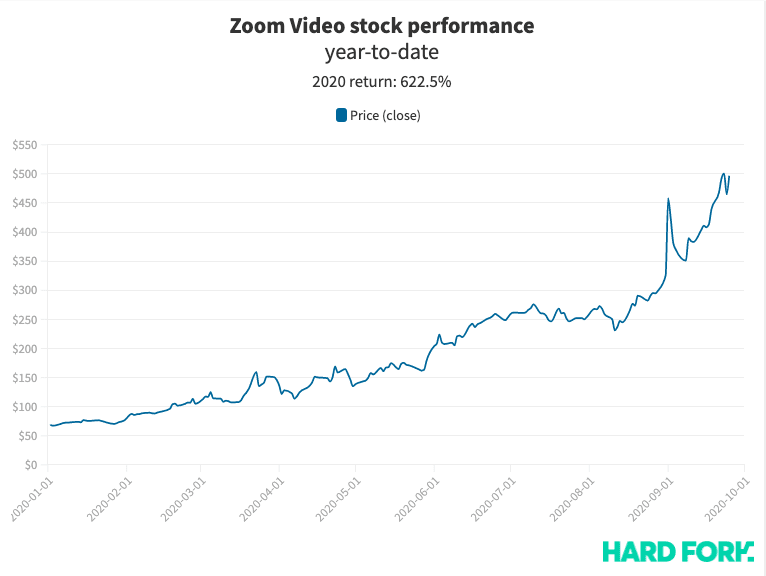

While SEC docs show that each Zoom insider sold shares according to pre-set trading plans, Yuan’s latest trades were even more profitable due to company’s raging share price.

Overall, Zoom stock has returned 622.5% year-to-date, having skyrocketed from $68.72 to $496.50 to propel its CEO to #43 on Forbes’ billionaires list. Zoom stock has also more than doubled since Yuan last sold stock in August.

[Read: Has Jeff Bezos ended world hunger? Twitter account skewers Amazon chief’s absurd $178B fortune]

To most people, Yuan’s $251 million is a fortune, but to Amazon’s baldking Jeff Bezos, it’s chump change.

Indeed, Bezos has dumped $7.2 billion worth of Amazon stock so far in 2020 — more than 12 times the money Zoom execs have collectively cashed in over the same period.

Published September 28, 2020 — 11:19 UTC